Advanced Micro Devices (AMD) has positioned itself as a dominant player in the semiconductor industry, benefiting from rapid advancements in AI, data center expansion, and competitive product offerings. As per recent financial data and market analysis, AMD presents a compelling investment opportunity in 2025. This article explores why AMD remains a solid buy, supported by strong growth prospects, expanding margins, and a robust balance sheet.

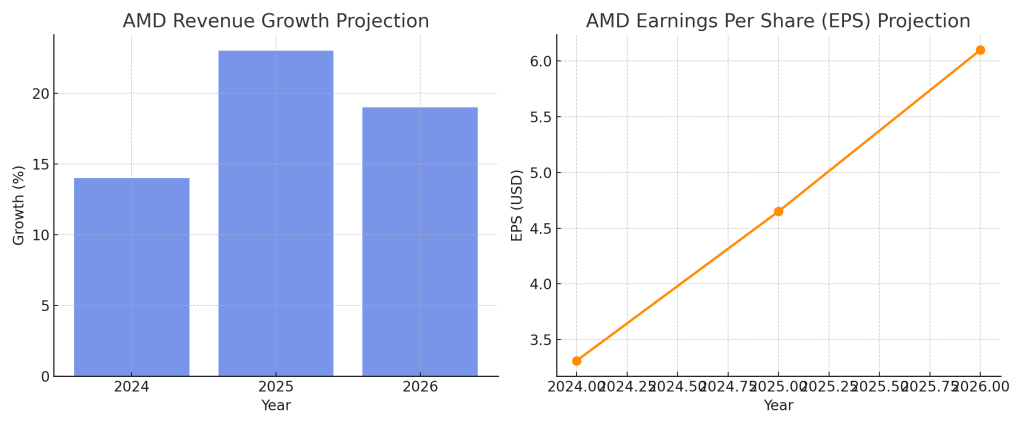

Strong Revenue and Earnings Growth AMD’s financial performance continues to gain momentum. Revenue is projected to grow by 23% in 2025 and 19% in 2026, following a 14% increase in 2024. The company’s earnings per share (EPS) estimates indicate a rise from $4.65 in 2025 to $6.10 in 2026, showcasing robust earnings growth. A significant contributor to this success is the data center segment, which is expected to see a 69% growth due to higher cloud capital expenditures and increasing CPU server market share.

Expanding AI and Data Center Market AMD is capitalizing on the rapidly growing AI market, with a projected $8 billion in GPU sales for 2025, up from $5 billion in 2024. The launch of next-generation products like MI325x/MI350x GPUs and Turin CPUs is expected to drive further adoption among major cloud providers, including Microsoft and Meta. Additionally, AMD’s acquisition of ZT Systems enhances its ability to offer comprehensive AI and data center solutions, further strengthening its competitive position against rivals like NVIDIA and Intel.

Margin Expansion and Improved Profitability Gross margins are expected to expand from 53% in 2024 to 54% in 2025 and 56% in 2026. This improvement is driven by increased sales of high-margin products within the Data Center and Embedded segments. As AMD scales production and shifts its focus toward AI and high-performance computing, profitability will continue to rise.

Solid Balance Sheet and Free Cash Flow Growth AMD maintains a healthy balance sheet with a net cash position and rising free cash flow (FCF). The company is projected to generate $6.5 billion in FCF in 2025 and $7.5 billion in 2026, up from $2.4 billion in 2024. This financial strength provides AMD with ample flexibility to invest in innovation, acquisitions, and shareholder returns.

Competitive Positioning and Product Innovation AMD’s EPYC server processors continue to gain market share, challenging Intel’s dominance in the CPU space. Additionally, AMD is rapidly evolving its AI accelerator roadmap, with the MI400 series planned for 2026. This focus on AI hardware, combined with its ROCm software advancements, positions AMD to benefit from the broader AI infrastructure expansion.

Favorable Valuation and Upside Potential With a 12-month price target of $140, AMD is trading at an attractive valuation. The stock is valued at 22.9x its 2026 EPS estimate, which is below historical levels and presents a compelling entry point for investors. Given the anticipated earnings growth and expansion in AI markets, AMD’s stock has significant upside potential.

Risks to Consider While AMD remains a strong investment, investors should be mindful of risks such as competition from Intel and NVIDIA, potential economic slowdowns affecting demand for computers and servers, and pricing pressures in the semiconductor industry. However, AMD’s continuous innovation and expanding presence in AI and data centers mitigate these risks effectively.

Conclusion AMD’s strong revenue growth, expanding AI and data center market presence, improving margins, and solid financial position make it a highly attractive investment in 2025. With accelerating demand for AI accelerators and next-generation processors, AMD is well-positioned for sustained long-term growth. Investors looking for exposure to the semiconductor industry and AI-driven expansion should strongly consider adding AMD to their portfolios.

Discover more from TEN-NOJI

Subscribe to get the latest posts sent to your email.